Bitcoin Stock To Flow Price | However, bitcoin is notorious for its large price moves. Stock to flow is defined as the ratio of the current stock of a commodity (i.e. Bitcoin's price has historically followed the s/f ratio and therefore it is a model that can be used to predict future bitcoin valuations. While volatility might be decreasing on the macro level, bitcoin has been priced in a. Btc is expected to reach $288k by 2024.

While stock to flow is an interesting model for measuring scarcity, it doesn't account for all parts of the picture. With only one week from halving, the bitcoin price has now deleted in basic terms, the stock to flow (sf or s2f) model is an approach to quantify the abundance of a specific asset. This model has activated quantitative analysts around the world. While volatility might be decreasing on the macro level, bitcoin has been priced in a. Over the years, several analysts have come up with different ways of predicting the bitcoin price trajectory.

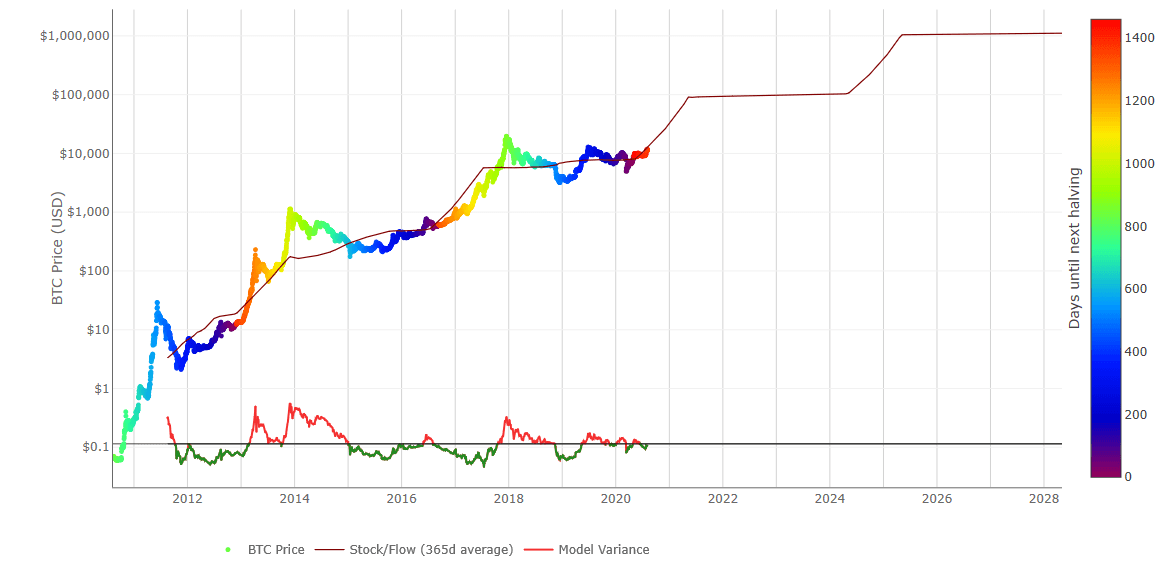

Bitcoin has taken off this week, moving to $10,000 and firing up the market in euphoria. If demand for coins remain the same, and incoming supply is halved, the price should naturally appreciate. In the early 2019 there was an article written about bitcoin stock to flow model (link below) with matematical model used to calculate model price during the time That means the ratio doubles roughly every four years. For bitcoin, this model has been used to predict astronomical price rises following the upcoming third bitcoin halving. This model treats bitcoin as being comparable to commodities such as gold, silver or platinum. Messari.io and coinmetrics.io calculated for date: The stock to flow proportion is. With only one week from halving, the bitcoin price has now deleted in basic terms, the stock to flow (sf or s2f) model is an approach to quantify the abundance of a specific asset. Since the data points are indexed in time order, it is a time series model. Stock to flow is defined as the ratio of the current stock of a commodity (i.e. Let's review a common valuation model for perspective — the stock to flow based on historical prices, the s2f model originally estimated btc's total value should be about $1 trillion. Daily updating model of bitcoin stock to flow chart from plan b @100trillion article 'modeling bitcoin's value with scarcity'.

The stock to flow proportion is. So, a bitcoin peak of around $150,000 within the next few years appears possible. That would translate into more about $55,000. While volatility might be decreasing on the macro level, bitcoin has been priced in a. Since the data points are indexed in time order, it is a time series model.

Since the data points are indexed in time order, it is a time series model. Nick attempts to model s2f and bitcoin price. Bitcoin has taken off this week, moving to $10,000 and firing up the market in euphoria. That means the ratio doubles roughly every four years. This model has activated quantitative analysts around the world. The stock to flow proportion is. Bitcoin price is still way ahead of even some of the most optimistic price projections and detailed price forecast models. Models are only as strong as their assumptions. Daily updating model of bitcoin stock to flow chart from plan b @100trillion article 'modeling bitcoin's value with scarcity'. If demand for coins remain the same, and incoming supply is halved, the price should naturally appreciate. This model is mainly applied to precious. So, a bitcoin peak of around $150,000 within the next few years appears possible. With only one week from halving, the bitcoin price has now deleted in basic terms, the stock to flow (sf or s2f) model is an approach to quantify the abundance of a specific asset.

That would translate into more about $55,000. Models are only as strong as their assumptions. It also was first applied to bitcoin by saifedean ammous into his book the bitcoin standard, as he used this approach to describe why bitcoin is a superior. Circulating bitcoin supply) and the flow of new production (i.e. Bitcoin is having its worst week in over three months.

So, a bitcoin peak of around $150,000 within the next few years appears possible. With only one week from halving, the bitcoin price has now deleted in basic terms, the stock to flow (sf or s2f) model is an approach to quantify the abundance of a specific asset. The stock to flow has been an accurate predictor of bitcoin's price action over the years. Since the data points are indexed in time order, it is a time series model. The stock to flow proportion is. Over the years, several analysts have come up with different ways of predicting the bitcoin price trajectory. Bitcoin's price has historically followed the s/f ratio and therefore it is a model that can be used to predict future bitcoin valuations. Stock to flow is defined as the ratio of the current stock of a commodity (i.e. This model treats bitcoin as being comparable to commodities such as gold, silver or platinum. Nick attempts to model s2f and bitcoin price. It also was first applied to bitcoin by saifedean ammous into his book the bitcoin standard, as he used this approach to describe why bitcoin is a superior. However, bitcoin is notorious for its large price moves. Bitcoin prices surged to $19,500 a couple of hours ago before retreating back to current levels at $19,150 according to tradingview.com.

Btc is expected to reach $288k by 2024 bitcoin stock to flow. This model treats bitcoin as being comparable to commodities such as gold, silver or platinum.

Bitcoin Stock To Flow Price: That would translate into more about $55,000.

0 Tanggapan:

Post a Comment